UK investment opportunities for a decisive decade

From Brexit to 2030 via climate change and a global pandemic; the 2020s are shaping up to be an eventful decade for the UK economy.

Join Citywire and J.P. Morgan Asset Management to make sense of what might happen.

Featured articles

The long and short of it: Review of the markets in May

I went out for dinner in London the other night… inside a restaurant. The novelty of the occasion made my fellow diners and me slightly giddy with delight. Given how absolutely abysmal the weather has been since the government allowed...

Why digitalisation matters

Do digital leaders outperform digital laggards? Corporate management teams and investors have considered the value of digitisation for years, with varying degrees of seriousness. When the pandemic forced a previously unimaginable amount of the world’s interaction –...

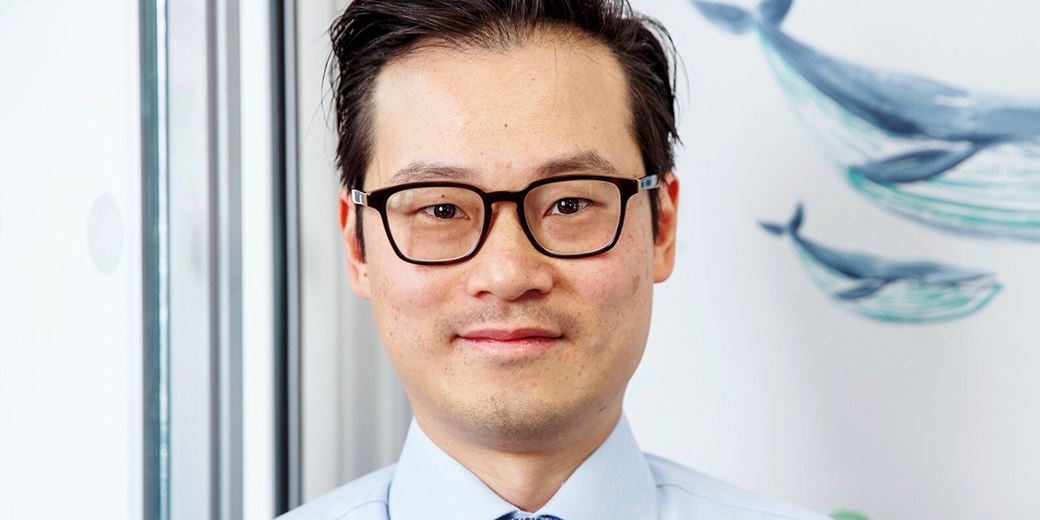

New kid on the block with experience at the helm – JPM UK Equity Income Fund

The JPM UK Equity Income fund adopts an unconstrained approach to income investing, seeking companies across the market cap and dividend yield spectrum to offer capital growth alongside an attractive dividend yield. Companies held in the portfolio typically fall under...

Register for our JPM UK Equities Webconference

Wednesday 26 May 2021 - 9:30am – 10am The outcome of Brexit has reinvigorated investor interest in the UK equity market. Join James Illsley, Portfolio Manager, and Andrew Robbens, Investment Specialist, as they...

The power of engagement

JP Morgan Asset Management’s investment stewardship specialists undertook 500 engagement discussions with 402 portfolio companies globally last year. Engagement with 96 of these companies focused on at least two ESG factors. The team...

Good influence

As environmental, social and governance (ESG) factors become more ingrained in the investment landscape, managers with deep in-house resources like JP Morgan stand to make a big difference to...

The long and short of it: Review of the markets in April

The road to reopening continues to proceed as expected in the UK. I went into the office a couple of times in April after a year out (with the exception of picking up my bike last summer). On one day my floor was so quiet that the lights, which are triggered by motion...

Cognitive errors in sports and investing

As a Chelsea fan I was delighted with the outcome of last weekend’s FA Cup semi-final between Chelsea and Manchester City. But Chelsea’s defensive solidity and delightful counter attacking play is not what this article is about. The game provided a more...

Latest news

Blackfinch AM launches ESG multi-asset fund range

Blackfinch Asset Management has launched four environmental, social and governance (ESG) approved multi-asset unit trusts, as it makes its move into the retail investment space. The trusts, which will be known as the Adaptation Funds, will blend both active and...

Blue Whale defies crisis to grow by £124m

The Peter Hargreaves-backed Blue Whale Growth fund has defied the recent market volatility to grow by more than £100m since the beginning of the coronavirus crisis. The fund, which has returned 58.6% since inception in September 2017 to 10 June and...

M&G eyes IFAs’ model portfolios for PruFunds after Ascentric deal

M&G is making a big play in the UK wealth space following its Ascentric platform deal and wants to use the acquisition get the fund range into IFAs’ model portfolios. With £53bn in assets at the end of 2019, PruFunds is a giant in the advised world but it is often...

Seven managers to exit in Jupiter/Merian fund shake-up

Jupiter has committed to a significant shake-up of its product range following its merger with Merian, with seven managers exiting and a number of sales staff being made redundant. From Merian, managers Ian Ormiston, Rob James, Mark Greenwood, Citywire...

IA calls for FTSE transparency over dividend payments

FTSE companies that suspend dividend payments as a result of current market uncertainty will be expected to restart them ‘as soon as it is prudent to do so’, the Investment Association (IA) has said. In a letter sent to all FTSE chairs on behalf of its members...

FTSE falls as virus slowdown hopes fade and Tesco hit

The FTSE 100 has fallen as hopes of a slowdown in the spread of the coronavirus pandemic faded, insurers weighed after cancelling their dividends and Tesco (TSCO) cooled bullishness on the supermarket sector after warning on costs. The UK blue-chip index...

Rathbones adds £450m with Barclays Wealth unit acquisition

Rathbones has completed the acquisition of Barclays Wealth’s personal injury and court of protection business for an undisclosed sum. The deal, which was announced at the end of last year, will see around £450m worth of assets transferred to Rathbones. As part of...

FTSE rallies as coronavirus deaths slow

The FTSE 100 has rallied after a slowdown in coronavirus deaths in France and Italy over the weekend, while European governments began preparations to ease lockdowns put in place to contain the spread of the pandemic. The UK blue-chip index jumped 93 points, or 1.7%...