Structural growth stories form the bedrock of Mercantile, the mid- and small-cap investment trust. Changes made to the portfolio since the onset of the coronavirus pandemic also make it well placed to capitalise on recovery stories.

An appraisal of the resilience of holdings as Covid-19 hit compelled its managers to sell companies where they believed the investment case was no longer valid – among them Shaftesbury, the West End London property investor, and energy firms Hunting and Premier Oil, both of which were likely to suffer from the depressed oil price. They recycled the capital into higher quality businesses at overly depressed valuations, initiating new positions in ‘Covid winners’ like Premier Foods and Pets at Home. They participated in a double-digit number of equity raisings on favourable terms, too. ‘Their shares have since recovered well,’ said lead manager Guy Anderson.

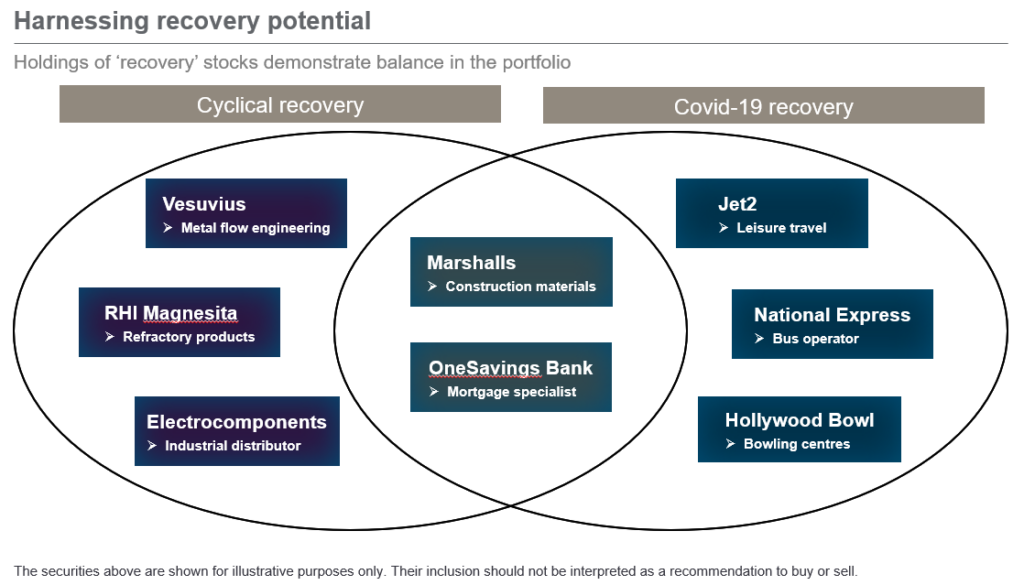

He has been mindful to maintain his long-term perspective and retained ‘Covid losers’ at the depths of the market rout – even adding to names like coach operator National Express. Despite restrictions on mobility, its revenues have held up relatively well due to a large portion being contracted, and cash burn has been minimal (unlike many other companies exposed to travel).

Covid-19 recovery

Between November and January, as the managers’ confidence in the Western world emerging from Covid-19 grew, they increased exposure to potential beneficiaries like travel operator Jet2. ‘We want to lean into those areas where we can see a substantial earnings recovery trajectory. Whether it comes this summer or next, the recovery in leisure travel will come,’ said Anderson. He deems Jet2 to be among the ‘market leaders of tomorrow’. A number of its competitors have ceased to operate and the predominant one, Tui, is in a significantly worse financial position.

Bowling centre operator Hollywood Bowl is another holding that stands to benefit from the lifting of restrictions and broadly rude health of consumer finances. ‘Unlike most recessions when consumers feel stretched, there’s pent-up demand and huge capacity to spend,’ said Anderson. ‘We’ve seen a wave of consumption play out in the first half of the year – the portfolio has benefited.’

Cyclical recovery

Industrials command the second largest slug of the trust’s assets behind consumer discretionary stocks. A position in refractory products supplier RHI Magnesita was initiated earlier this year. It stands to benefit from the cyclical recovery alongside metal flow engineering company Vesuvius and industrial distributor Electrocomponents.

Anderson points to strong management of these companies’ during the recession, which removed costs and put them on track for ‘substantial’ growth in profits as the economy rebounds and industrial output recovers. ‘They’re attractive long-term structural stories and in the short-term the upswing in cyclicals is providing a kicker to returns,’ he said. ‘Over the past six months we’ve seen capex really coming through across every aspect of industrials other than aerospace, which remains in the doldrums.’

Is rising inflation a problem for these businesses? On the contrary, he believes it will ultimately be of benefit. ‘A bit of inflation is a good thing for structurally strong businesses – it helps them to push through price increases,’ he said. That not only supports share price growth but helps companies to generate more profits, which they can reinvest for growth or return to shareholders through dividends.

While emphasising capital growth, Mercantile also aims to grow its dividend at least in line with inflation and achieved this last year despite a 46% drop in underlying revenue. In the year to end-January its dividend rose 1.5% (while inflation ticked up 1.4%) thanks to deep revenue reserve that has been accumulated in more favourable times. Underlying dividends are recovering faster than anticipated, added Anderson, which should position the trust well for continued future dividend growth..