High growth businesses are taking the UK stock market by storm in a flurry of initial public offerings (IPOs) that promise to rejuvenate its staid image. They are providing rich pickings for mid and small-cap investment trust Mercantile.

Having participated in just one IPO last year, its managers have backed six new market entrants so far this year. ‘Last year was incredibly quiet for IPOs,’ said lead manager Guy Anderson. ‘This year has been the reverse, with the UK is the second most active market globally for new issues behind the US.’ UK listings raised £5.6 billion in the first quarter – more than any other first quarter since 2007 and any single quarter since the second quarter of 2014, according to EY IPO Eye. That stands in stark contrast to the £615 million raised during the first quarter of last year and is more than half the £9.4 billion raised throughout 2020.

Anderson expects IPO activity to remain high but points to signs of ‘deal fatigue’ and the importance of remaining selective: ‘We maintain our disciplined approach and have no interest in getting distracted by the next shiny new thing.’

Cherry picking

In December, Mercantile participated in the flotation of software firm Bytes Technology Group with aspirations to replicate the success of Softcat. The latter was added to the trust at IPO in November 2015 and has been one of its best-performing investments. Other companies bought at IPO this year are iconic footwear brand Dr Martens, which raised £3.7 billion in January; online greeting card company Moonpig and Auction Technology Group, which raised £1.2 billion and £600 million respectively in February; and Seattle-based game publisher and developer tinyBuild, which made its £340 million stock market debut in March, becoming the largest US company ever to list on AIM.

‘There is not a preponderance of high growth businesses in the UK so it’s exciting to see so many of them coming to the London market,’ said Anderson. Recent IPOs participated in are already bearing fruit for the trust, many of them plentifully. However, one it passed on was Deliveroo. It was valued at £7.6 billion when it floated in March, making it the biggest IPO since 2011 and Britain’s largest ever tech listing. Shares in the food delivery company shed more than one-quarter of their value on the opening day and have subsequently have lost more ground. ‘We looked at it, including the issue of workers’ rights,’ said Anderson. ‘Our main objections were that the business has never generated any profits and the valuation was far too high.’

Disciplined approach

Mercantile’s investment philosophy is grounded in identifying three key characteristics: a quality business (reflected in profitability, sustainability of earnings and capital allocation discipline), trading at an attractive valuation, which stands to benefit from an improving outlook.

In identifying sustainable businesses with enduring competitive advantages the managers increasingly consider environmental, social and governance (ESG) factors. These are integrated into the process, with companies being evaluated through a 40-point analyst checklist and regular, in-depth engagement occurring in company meetings held by the team (numbering over 350 per year).

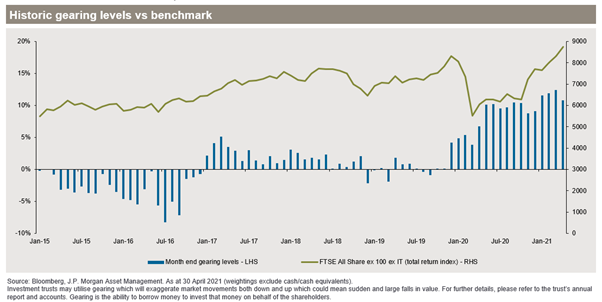

What the managers aim to deliver to the trust’s many investors (Mercantile being the largest UK equities investment trust) is access to tomorrow’s leaders. Indicative of their optimism in the prospects for mid and small-caps is the level of gearing, which stood at 12.1% at the end of May and has been as high as 12.4% this year – the highest since 2012.

While gearing has added to relative outperformance over both short and long timeframes, the greater contributor has been a disciplined approach to stock selection – both picking winners and discarding losers. ‘We accept that we make mistakes and seek to manage the damage of the losers,’ said Anderson.

This disciplined approach to stock selection has delivered strong performance over the long-term. The same principles are being applied to the flurry of IPOs the UK market is currently experiencing, helping the managers cherry-pick the truly attractive opportunities.

Mercantile’s gearing is historically high