Galvanised by the general election result and ‘Boris bounce’, savers poured £1.3 billion into UK equity funds in December – inflows not seen since 2013. This new-found confidence was felt across the UK commercial community, with demand for funds investing in large, mid and small caps, data from the Investment Association shows.

Global markets were hovering around their January highs until late February, but started to falter amid news that the coronavirus had spread outside of China, with Korea and Italy imposing containment measures.

Other macroeconomic factors, from the start of trade negotiations with the EU to the US presidential election, stand to impact investor sentiment and could spook stock markets in the short term.

We asked professional investors about the ways they are mitigating risk.

FOCUS ON QUALITY

Ravenscroft, an investment services group based in the Channel Islands, has been positive on the long-term outlook for UK assets for some time but became more optimistic following the election.

‘With a substantial majority and a five-year mandate, the government can embark on a strategy of sensible fiscal expansion backed up by business-friendly structural reforms targeted at boosting productivity and economic growth,’ said chief investment officer Kevin Boscher.

However, the UK is not immune from the fragile global macroeconomic backdrop and Brexit-related headwinds remain. Ravenscroft is defensively positioned overall with a focus on quality companies.

‘We invest predominately in UK equity funds, which have been thoroughly researched and where we are confident in the manager’s ability to generate superior returns while managing risk,’ said Boscher. ‘We also invest in direct UK stocks and are focused on quality companies, where we understand the business model, as we believe they will generate superior long-term growth and are attractively priced.’

DIVERSIFICATION

Charles Stanley also has a positive view on UK equities as asset allocators nudge up their exposure but is ‘under no illusion the UK is out of the woods yet’.

‘Our first approach as equity investors is diversification – not just owning a basket of companies but ensuring we have sector, size and stylistic diversification,’ said investment manager Will Dobbs.

‘We own companies that look expensive, but if they have recurring revenues, earnings and dividend growth that gives us a margin of safety. We also own unloved companies that have the potential for re-rating, as long as there’s a catalyst for change or underappreciated growth.’

The wealth manager uses UK absolute return funds throughout the cycle to protect against unforeseen shocks and weak markets generally. ‘We’ve recently increased our adoption of these types of funds, mainly because equities have been strong so we’re taking some risk off the table,’ added Dobbs.

LONG/SHORT STRATEGIES

Investors can mitigate stock market risk by having some exposure to short positions – those that profit when a company’s shares price falls or underperforms a benchmark.

‘Globally, we find that markets are generally overvalued, particularly the US,’ said Daniel Vaughan, director of manager research at Morningstar.

‘That means future returns from global equities are going to be considerably lower and there may be some benefit to seeking out excess returns through taking short exposure.

‘The UK market looks better relative value than many other stock markets, although within the market there will likely be some opportunities to short.’

Equity long/short strategies can reduce risk only when the manager can add value through both long and short calls, he said, emphasising the importance of identifying a manager with proven stock selection abilities on both sides.

UNDERWEIGHT POSITION

Before the 2016 EU referendum, Brooks Macdonald had a neutral position in UK equities as well as a bias towards small and mid-caps. As the political risk increased, so did its exposure to larger multinationals, while its overall UK equities exposure was reduced to a large underweight.

In November, December and January, the wealth manager added to UK equities, buying Brexit-sensitive domestic stocks and global multinationals trading at lower valuations than European and US peers.

‘We took the view that political risk was likely to reduce after the UK election. This would give global asset allocators some breathing space to reconsider UK valuations even though trade negotiations would continue throughout 2020,’ said deputy chief investment officer Edward Park.

‘EU/UK trade negotiations are likely to generate flashpoints of volatility as the year progresses, reaching a crescendo by December. For that reason, we still maintain an overall underweight for the short term.’

STRUCTURED INVESTMENTS

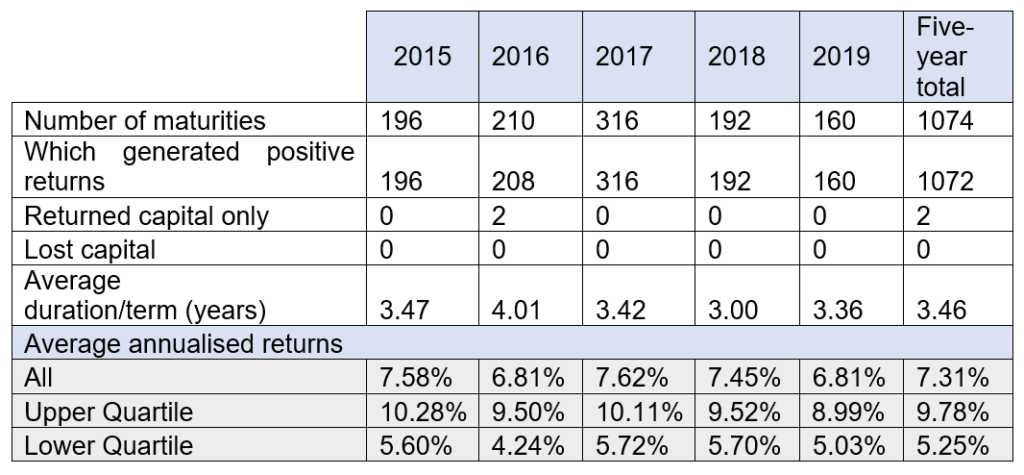

Ian Lowes, managing director of Newcastle-based Lowes Financial Management is a long-term structured investment proponent. He said he is ‘still banging the same drum because it proves to play the right tune year in, year out [see table]’.

Structured investments have maximum terms of up to 10 years. If the stock market rises over that timeframe, a typical, simple FTSE 100-linked auto-call structured investment could mature after two years with a 20% gain. If the index drops and it takes, say, eight years to recover, then the same product could mature at that point with an 80% gain. If the market slumps and does not recover, the investment would return the original capital at the end of 10 years. Unless the index is more than 30% lower, in which case it would track the fall.

‘One structured investment won’t fit the bill, but a portfolio of similar strategies with differing potential maturity dates, capital protection barriers and counterparties should serve investors well,’ said Lowes.

ESG INTEGRATION

Canaccord Genuity Wealth Management views effective integration of environmental, social and governance (ESG) factors as a crucial mechanism for tackling risk in UK equities.

‘The UK index at a headline level is characterised by relatively high exposure to relatively low-quality companies in terms of ESG – in areas like energy and mining. Worse still, the UK active peer group tends to hug the benchmark,’ said Patrick Thomas, its head of ESG investing.

He sees sustainability as an attractive lens for stock selection. Funds that integrate ESG analysis tend to have more exposure to companies that are in growth markets linked to sustainable issues – clean water, sustainable food production and hydropower, for example.

‘We tend to see portfolios of companies with high barriers to entry, aligned management teams and sustainable competitive advantages,’ said Thomas. ‘We think of this as another way of accessing [Warren] Buffet-style moats – funds focused on sustainable long-term growth rather than short-term performance.’

FTSE 100 LINKED RETAIL STRUCTURED INVESTMENT MATURITIES BY YEAR