The key point of difference for JPM UK Equity Plus is its ability to short. In my previous two articles on the JPM UK Equity Plus fund, “Extending the alpha opportunity in UK equity” and “Standing out from the crowd in UK equity” I explained how shorting gives us, as portfolio managers, both a differentiated potential alpha stream and a different risk profile to our peers, including a tool to manage a risk that is often associated to this technique, liquidity risk.

Macro risk

In a portfolio it is easy to build up correlated risks. For example, a manager may have high exposure to the UK consumer, or oil price or base metals. Long only funds have limited ability to manage these risks.

Take the general retail sector. A manager might be overweight Dunelm, JD Sports and Next, but if they hold all these stocks in size they will have exposure to the UK consumer. It is hard to offset that as even if they go underweight all the other general retail sector it is unlikely to be sufficient to reduce this risk.

Shorting not only gives a manager another alpha opportunity by shorting those general retailers he or she views as the weakest in the sector, but this is also a tool to reduce the funds risk, in this case by shorting away some of the exposure to the UK consumer.

Size risk

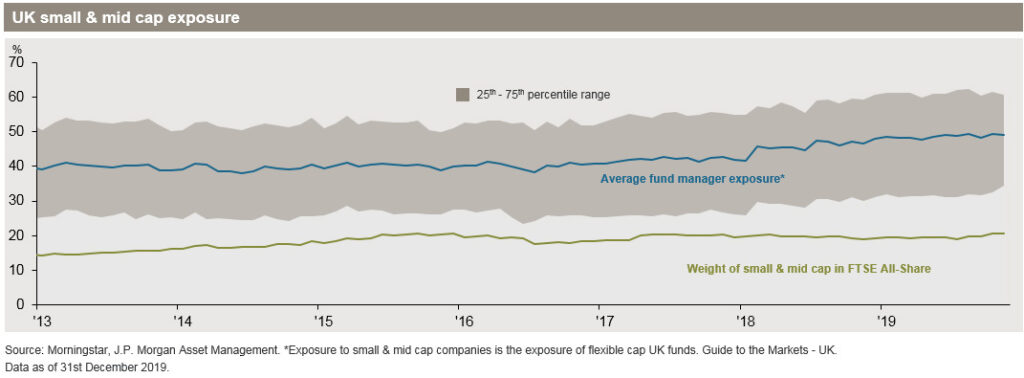

In the UK, the average fund manager has around 45% of their fund in in small and mid-cap stocks compared to the FTSE All-Share index weight of around 20% (see Fig.1 below).

Figure 1 UK small & mid cap exposure

Many fund managers will say that small and mid-cap stocks are less efficiently priced due to sparser sell side coverage and so offer the most attractive opportunities for active managers. If you except that small and mid-caps are less efficiently priced then some must be overvalued as well as undervalued. It cannot be a one way bet and so there must be small and mid-cap stocks that are attractive to short.

As I mentioned in my previous article, in 2019, the 10 worst performing stocks in the FTSE All-Share were all small and mid-caps and of the 102 stocks that underperformed the benchmark by 20% or more, about 90% were small and mid-caps. We were able to short 8/10 of the worst performing stocks, which generated significant alpha for the fund, but it also helped reduce our small and mid-cap net exposure (this is only an example – as always, past results are not indicative of future results).

In JPM UK Equity Plus we have considerable gross exposure to small and mid-caps, including those we consider as inefficiently priced, but we go long those we like and short those we do not. The result is our net exposure to small and mid-caps is not meaningfully different to the benchmark. This gives the benefit of a differentiated source of potential alpha but also the benefit of targeting a reduction of our size risk.

For more information on shorting as a tool for alpha generation and how it can open up the UK equity market, please see our other articles on the UK Edge.

For Professional Clients only – not for Retail use or distribution. This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are, unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Prior to any application investors are advised to take all necessary legal, regulatory and tax advice on the consequences of an investment in the products. Investment is subject to documentation, which is comprised of the Prospectus, Key Investor Information Document (KIID) and either the Supplementary Information Document (SID) or Key Features/Terms and Conditions. These documents, together with the annual report, semi-annual report and instrument of incorporation are available free of charge from JPMorgan Asset Management (UK) Limited. This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

0903c02a8285a351