‘[Covid-19] is a health crisis, a social crisis, a financial crisis and an institutional crisis all rolled up, each feeding off the other, and it’s on a global scale’. Will Meadon, JPMorgan, Claverhouse investment Trust.

As equity markets started their descent into the steepest bear market in history, the managers of JPMorgan Claverhouse investment trust were reducing gearing – to zero by the end of February compared to 9% in January. In April, they reinstated 5% gearing as they tentatively bought into the corporate ‘survivors’ club’ of the Covid-19 pandemic.

‘At the start of the year we foresaw a clearing of the skies following the Conservative’s landslide victory, Boris Johnson’s vision of leaving the EU and a renaissance of the UK economy after a three-year hiatus,’ says Will Meadon, who has run the trust for eight years, the last two alongside co-manager Callum Abbot.

‘But after the first case of coronavirus was found in the US on 20 January and the UK on 31 January, it became clear to us that this was going to be a global crisis.

‘We have witnessed the fastest-falling bear market of all time – the scars are going to remain for a while – but as managers, we are thinking about what the new world is going to look like.

‘We are taking the opportunity to buy into the survivors’ club – the strongest companies with low debt levels and the ability to generate cash even in this fairly bleak scenario when revenues aren’t nearly as high as they’d like them to be.’

Among them, he counts housebuilders like Berkeley Group, life assurers like Phoenix and retailers with a strong online presence like Next: ‘They should be able to come through this in good shape.’

The coronavirus pandemic is arguably the greatest crisis that Meadon has seen in his near 40-year career.

‘It is a health crisis, a social crisis, a financial crisis and an institutional crisis all rolled up, each feeding off the other, and it’s on a global scale,’ he says.

‘There will be no bell that rings to say: “This is the end of it”. There will be a long road to recovery. It’s unprecedented and it’s challenging, but that doesn’t mean I’m not optimistic about how Claverhouse can deal with it.’

Wonderful reserves

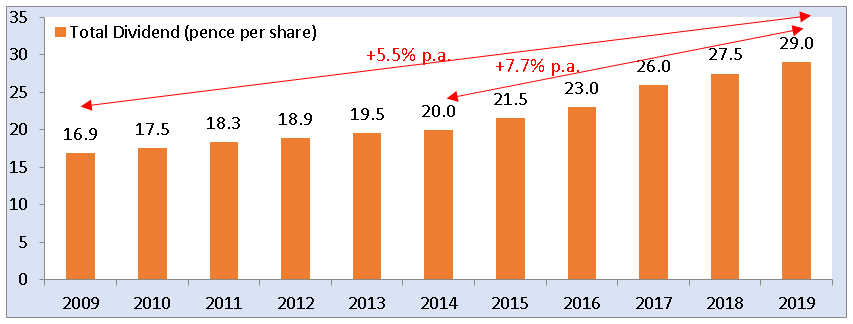

JPMorgan Claverhouse seeks both capital growth and income from a portfolio of UK companies that typically numbers 60 to 80 (61 at present). It has been around for 57 years and last year celebrated its 47th consecutive years of dividend growth – a record that its board is surely keen to uphold.

This year, it declared a first quarter dividend of 6.5p, up from 6.25p a year ago. Its revenue reserves equate to 1.2 times 2019’s total dividend per share of 29p. That gives it the most substantial reserves of any trust in the UK equity income sector, an analysis by Numis shows.

As companies cut or freeze their dividends – some of them, because they are accepting government help in furloughing staff, not because they do not have cash they could return to shareholders – the income being generated by the trust is affected.

However, the managers’ prime focus on quality means that Meadon expects the portfolio to suffer a drop in income at the lower end of the 30-50% decline in UK dividends pencilled in by analysts.

‘We’ve modelling a range of scenarios and even in the worst-case scenario we have more than a year’s worth of dividends tucked away in our wonderful reserves – we have the ability to increase our dividend by calling on them,’ says Meadon.

‘That is why we are being able to issue shares, often at a small premium. Investors who want an income can depend far more on an investment trust than any open-ended fund.’

HOW JPMORGAN CLAVERHOUSE HAS GROWN ITS DIVIDEND