Technology is not a conventional stomping ground for income investors but is proving an important source of returns for Citywire AAA-rated JP Morgan manager Katen Patel. He is finding opportunities in companies that play to such themes as digitisation and the energy revolution despite many of them yielding little or nothing.

‘Some are early in their lifecycle and pay no dividend at all, but it’s underlying cash generation that’s important to us,’ he said. ‘They have a long runway of growth – our hope is that they’re the large caps of the future.’

Patel, a smaller companies specialist, has run the JPM UK Equity Income fund since its inception three years ago alongside John Baker, a veteran in large and mid-cap investing. The pair take an unconstrained, flexible approach and blend companies at different stages of development – a strategy that returned 16.8% before the stock market sell-off versus a 13.3% rise in the FTSE All-Share index. In the three years to the end of May, the fund was -4.4% versus -8.7% for the index.

It aims to generate long-term capital growth while maintaining a yield premium to the FTSE All-Share index. Typically, this yield premium has sat between 10-15% and is currently 13% higher on a prospective basis. The forward yield on the fund is 4.9% compared to the index at 4.35%.

‘For most of our companies the impact should be short-term,’ said Patel. ‘We are likely to see rebasing of dividends across the market, but we don’t invest in loss-making companies and are confident our holdings can survive and come out the other side stronger than the competition.’

Patel and Baker combine proprietary screening and risk analysis with fundamental research to ascertain balance sheet strength and profitability. That is reflected in the fund’s dividend cover and free cash flow yield of 2.9x and 8% respectively versus 2.7x and 6.8% for the index.

Sweet spot

Small and mid-cap companies with a market capitalisation between £500m and £1.5bn are the managers’ ‘sweet spot’. The fund has a 35% allocation to these ‘undiscovered gems’, 10% overweight relative to the index.

They sit across their ‘quality compounders’ and ‘high growth’ buckets with a third bucket focusing on more mature, high yield companies. High growth companies typically operate in emerging industries and post annual earnings growth of 10%-plus. They are beginning to dominate their home market and using profits to expand into new geographies or develop new products and services at the expense of returning cash to shareholders. The managers sometimes buy them at IPO – a rich source of capital returns. ‘They provide diversification away from old world stocks,’ said Patel.

Compounders still have a decent runway of growth but are at a later stage of development. They often benefit from structural growth drivers, such as the switch from high street to online retail. Some are looking to grow through acquisition, but if an attractive takeover target fails to materialise choosing to return cash to shareholders by way of special dividends.

They typically yield 2-3% compared to 4%-plus for high yield stocks in more mature industries. ‘Income investors get drawn to the obvious large cap names, but there are a lot of companies further down the market cap spectrum that have healthy balance sheets, strong cash generation and stable yields,’ said Patel.

‘We want a mix of companies that we can own for the long term. The problem with only investing in high yield stocks is that your portfolio willshrink over time because the companies you hold are not growing. If you balance them with companies that are growing their earnings and growing their dividends, the absolute amount of income you generate over time is going to grow as well.’

Data on before sell-off from 31 May 2017 to 24 January 2020 (peak for the fund), FE Analytics

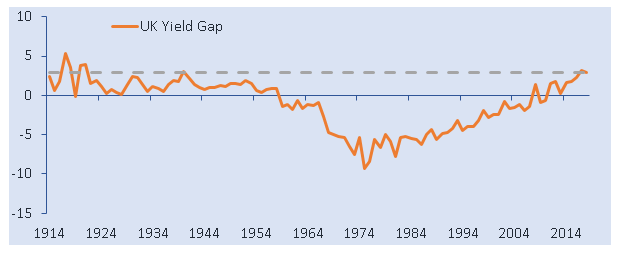

MIND THE GAP

The yield on UK equities relative to gilts is the most attractive it has been since the First and Second World Wars [DATASET ATTACHED – akin to the below but updated to 25 May 2020] Y axis denotes %