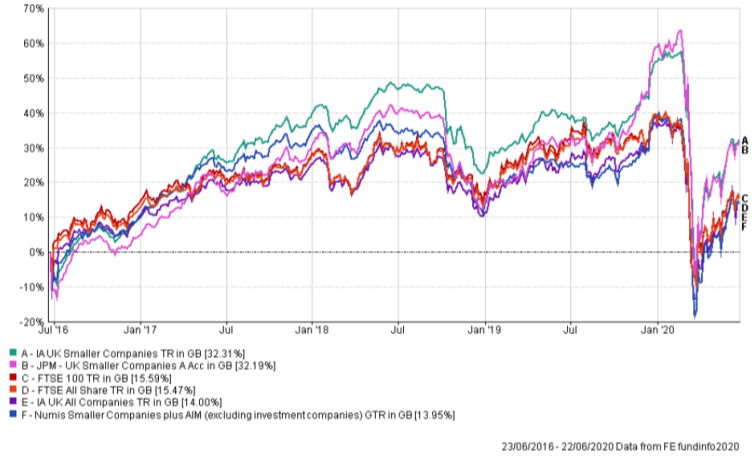

UK smaller companies funds have produced more than double the returns of funds with a larger or multi-cap focus in the four years since the EU referendum. The average return in the IA UK smaller companies sector in the four years to 22 June is 32.3% – 130% more than an average 14% gain in the IA UK all companies sector.

At an index level, the Numis Smaller Companies plus Aim index has risen 14% over the same period, marginally behind a 15.5% increase in the FTSE All-Share index.

The strong outperformance of smaller companies funds over both the index and all companies funds points to stellar stock-picking among their managers and dispels the notion that small and micro companies are most susceptible to economic weakness resulting from curveballs like Brexit or Covid-19.

‘The figures will surprise many people,’ said JP Morgan fund manager Georgina Brittain, one of the longest tenured in the UK smaller companies space. ‘We feared there would be an immediate impact [to smaller company performance following the referendum] but were proven so wrong so quickly about the strength of our companies. Performance has been incredibly strong and until the events of this year, companies were still trading extremely well.’

Brexit is a risk that has not gone away, but one that the coronavirus pandemic has seriously diminished.

‘In the here and now our key focus is on Covid – the short-term and longer-term impact – but feeding into that is Brexit,’ said Brittain, who has run the JPM UK Smaller Companies fund for 22 years, the last five alongside co-manager Katen Patel.

‘Brexit has been on our minds for five years – since almost a year before the referendum. If we have a hard Brexit at the end of this year, which is looking less likely by the day, in a post-coronavirus world the impact will be less – less on investors’ thoughts about the UK and less on our companies because the world for them has changed.’

Number one lesson

Having worked in fund management for 25 years, a career spent entirely at JPMorgan, Brittain has invested through various booms and busts. The crucial difference with the current crisis is its roots in an unquantifiable risk – a virus that is not yet understood and long-term repercussions that are not yet known.

‘In some sense, I’ve seen it before,’ she said. ‘At the end of February and early March, as markets went into freefall, my number one lesson from crises like these is that in times of panic it’s too late to panic. You must look it in the face. Stop and take stock – stock by stock.’

Brittain and her team ‘drilled down’ to every stock in the portfolio (and others that are not) to assess balance sheet strength, likely capital requirements and their willingness to put extra capital to work. ‘Would we be prepared to put more money in to support the company? If not, we shouldn’t own it,’ she said.

While it might take until at least next year for the IPO market to come back, she expects to see more rights issues this summer.

During the financial crisis shareholders had the chance to increase their stakes at deep discounts – a ‘fantastic buying opportunity’. Though most recent placings have been at market prices that could soon change.

‘We’ve participated in less than we expected,’ she said. ‘It’s very possible that this is stage one and we see more rights issues over the summer that are larger in size and more attractive – that’s when we’ll see the 10% and 20% discounts.’

She is prepared for those: ‘We have some cash and some stocks where we could potentially take capital off the table to redeploy,’ she added.

HOME RUN FOR SMALLER COMPANIES FUNDS