We are in the process of moving house. It’s really a function of a two bed flat in London being a bit cramped for a soon to be family of four rather than any call on the housing market. We went to see a property the other weekend and have subsequently had our offer accepted. I sit here now thinking about the place. I know I liked it and it ticks all the boxes – but is a fifteen minute walk around a house really a good base for the biggest purchase I’ve made in my life? My clients will be glad to hear I tend to spend a lot longer looking at stocks before making an investment decision.

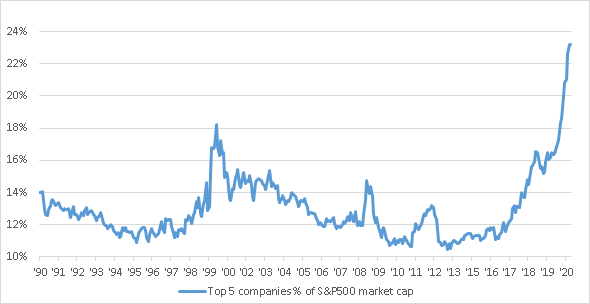

The UK equity market ground higher over the month without specific drivers. The S&P 500 has hit all-time highs driven by the mega cap tech stocks. The chart below shows the combined index weight of the largest 5 companies in the S&P 500 (all are tech stocks: Apple, Amazon, Microsoft, Alphabet and Facebook). As the chart shows, the percentage of the index that is made up of the largest 5 companies is currently at an extremely elevated level. Structural trends have been accelerated by the pandemic and these tech stocks have been able to capture market share as economic activity has been forced online and into the cloud. On an equal weighted basis the S&P is 15% below all-time highs, which shows how concentrated this rally has been. In fact the top 5 companies in the S&P 500 make up a record percentage of the index (see the chart below). The UK looks a significant laggard as it is still around 22% below its high in May 2018. This reflects the lower weighting of tech stocks in the index. I believe normalisation of economic activity will see non-tech stocks disproportionately benefit, which means the UK looks well positioned to perform strongly in this environment.

We’ve seen flare ups in infections appear in a number of countries in Europe. These tend to be focused in a specific area and are not on the scale of the first wave earlier in the year. However, the response has typically been to increase restrictions and this is impacting economic data as evidenced by the below consensus Eurozone Flash PMI readings for August (source Bloomberg).

The UK has been successful at clamping down on localised outbreaks and the current infection rate is one of the lowest in Europe (EUDC). In the UK it is reassuring to see the Flash PMIs for August are well above 50 (indicating expansion) and ahead of expectations. A concerning issue is unemployment. We do not have official data yet for July or August, however, it is hard to ignore that around 7.5 million people were furloughed as at the end of June and employers are now having to contribute towards staff pay. An early indicator for July suggest employees on payroll declined by 730,000 (ONS) Maintaining strong momentum in economic activity is crucial to avoiding an unemployment crisis, which risks derailing the recovery.

It is not just the economy at stake. The pandemic has not occurred in a vacuum. Education, mental wellbeing and (excluding Coronavirus) health have all taken a back seat. A Times article has suggested there are 15 million patients on NHS waiting lists (The Times). Politicians must consider a broad spectrum of priorities as they move forward.

An interesting snippet I heard from the CEO of a life insurance company is that they had not put up the price of their life insurance policies for anyone under 65 that does not have pre-existing health conditions. They do not do this out of charitable goodwill but because the statistics tell them it is not necessary.

The Long and the Short

The Long

Aveva is an industrial software company. It provides engineering, design and information management software and analytics to a wide variety of industrial end markets, which help their customer run their operations and assets efficiently. The company has been a consistent growth compounder for many years and we like its strategy of switching customers on to subscriptions, which increases the quality of the revenues and drives higher margins. Aveva recently announced the transformative acquisition of OSIsoft, another industrial software company with a complementary data management product. The combination will have diversified end markets across both industries and geographies. It will provide an opportunity to cross sell and drive significant growth as we move through the 4th industrial revolution.

The Short

WANdisco designs and develop enterprise software that helps migrate data to the cloud. At some point even the most conceptually exciting “growth stock” has to deliver some genuine revenue growth and a glimpse of what profitability may look like. WANdisco generated just $6m of revenue to the end of 2012, 7 years later to the end of 2019 it had revenue of just $16m, yet the market cap is $410m (c.£304m, as at 01/09/2020, Source Bloomberg and Company Accounts). We wonder whether the market will soon get tired of waiting.

The securities above are shown for illustrative purposes only. Their inclusion should not be interpreted as a recommendation to buy or sell.

For Professional Clients/ Qualified Investors only – not for Retail use or distribution. This is a marketing communication and as such the views contained herein are not to be taken as advice or a recommendation to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are, unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and investors may not get back the full amount invested. Past performance and yield are not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. This communication is issued in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. Registered in England No. 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

0903c02a829c81b0