JP Morgan UK Equity Growth fund manager Kyle Williams sells out of airlines and pubs and fills his basket with e-commerce starlets.

The Covid-19 pandemic has accelerated existing growth trends, the rise of online retail being a notable example and one that JP Morgan UK Equity Growth fund manager Kyle Williams has increased exposure to.

He has sold out of catering group Compass, pub chains JD Wetherspoon and Mitchells & Butlers, and airlines easyJet and Wizz Air and reinvested proceeds in companies benefiting from the shift from offline to online. He bought online supermarket Ocado in April and added fashion e-tailer Asos in August.

‘The pandemic has brought about a huge amount of change in a short period of time. As growth investors, it has led to some exciting opportunities,’ said Williams, who co-manages the fund alongside Ben Stapley.

He believes the stock market typically struggles to price such rapid change. Research has shown that it takes just 66 days for a new behaviour to become automatic and he expects the step change in online sales penetration to prove more permanent than the market currently forecasts, as ‘behavioural changes become embedded through a prolonged period of disruption’.

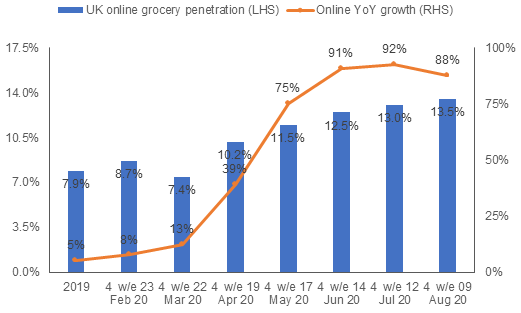

Online grocery shopping accounted for 7.9% of overall sales in 2019, up 5% on the previous year. Growth has skyrocketed to more than 75% in recent months, taking online sales to 13.5% of grocers’ total till rolls, according to data from Kantar (see chart).

‘Before Covid-19, many consumers resisted shopping for groceries online, preferring to pick their food personally and avoid extra fees, but the pandemic has altered behaviour,’ said Williams.

‘Shoppers have started shifting a higher share of their food spend online, looking for safety, convenience and ways of avoiding queues. We expect to see a significant acceleration in 2020 and beyond, from which Ocado is uniquely placed to benefit given its successful retail model and unique technology platform.’

Lockdowns have also accelerated the fashion industry’s transformation from offline to online. Asos is well placed to profit from this shift in retail spend having gained 2.7m customers in the last three quarters, considerably ahead of the whole of last year.

Positive surprises

Asos is seeing significant earnings upgrades – a key factor for the managers. In running JP Morgan UK Equity Growth, they look for high quality UK companies that are exceeding expectations.

They ask two key questions: Is it a good company and is it the right time to buy it? They consider quality through metrics like profitability, sustainability of earnings and capital allocation discipline, and then try to ascertain the operational momentum of a business and its ability to deliver positive growth surprises.

The result is a portfolio that is well diversified in terms of sector, company size and number of holdings. It has 126 holdings at present – more than many competitors.

‘We’re not targeting absolute levels of earnings growth but earnings that surprise on the upside, which locks us into more dynamic growth,’ said Williams. ‘The breadth of our approach allows us to unearth growth themes across the market.’

The investment philosophy has not changed since the fund was launched in December 2008, but Williams says JP Morgan as an investment house is always looking for ways to ‘refine our edge’, both from a quantitative and fundamental perspective.

Big data is an area in which the fund manager is investing heavily. Earlier this year, it embedded a natural language processing model into its investment process.

It provides a further layer of analysis of market announcements. The model reads through the transcripts from conference calls and question and answer sessions with analysts that typically accompany quarterly results, analysing the language for particularly positive or negative sentiments. ‘It’s an enhancement that can boost alpha generation,’ Williams said.

UK ONLINE GROCERY SALES SKYROCKET