At the start of September we moved out of our flat. It is unbelievable how much clutter we have accumulated in three years. We wouldn’t consider ourselves hoarders, but the process of packing up does force some introspection. A rule of thumb I’ve heard is, if you haven’t used it in the last eighteen months you never will. Having said that, the ice bucket, cheese knife set and pickle fork all made the cut… 2021 will be the year of al fresco cheese and white wine!

It has been a weak month for equity markets. Rising infections and related restrictions across Europe, a lack of progress on Brexit negotiations and a lack of new fiscal stimulus in the US have led to a sell off. In a turn of fortunes it is the US market, and tech stocks, that have led the way down. However, the market has not exhibited the same degree of fear that we saw at the start of the pandemic.

In fact, towards the end of the month there was some optimism that agreement could be reached with a BBC article citing a trade diplomat saying “On technical issues we’re 90% there”. There is not long to finish the remaining 10%, which has the added problem of being political rather than technical.

After a summer of easing, we are entering an autumn (and probably Winter) of restrictions. I had hoped that the low infection rate we experienced through the second half of summer would continue. This has not been the case as infections rapidly increased through the month. Governments are clearly wary of repeating the failures of the first wave and so have responded with greater restrictions.

In the UK there were around 6600 new cases reported on 24th September, this compares to the peak in early May of 6200 (Source Wikipedia). However, this largely reflects the huge increase in testing, with best estimates that at the peak of the virus there were around 100,000 new cases a day (Source BBC News, 2020). ONS survey data suggests that current testing is probably only accounting for around a third of actual cases (Source ONS, 2020).

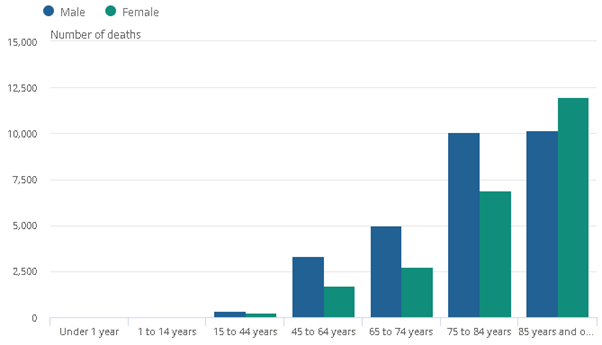

At the moment hospitalisation and deaths have not spiked in the way infections have (Source ONS. 2020). This is partly because therapeutics are better and partly because the infections have been concentrated in younger people which as the chart below shows, are at minimal risk of dying from this virus. New restrictions reflect a concern that the virus will filter through to more vulnerable cohorts but for the aforementioned reasons they should not be as onerous as a full lockdown.

The spike in infections suggests to me that this virus cannot be contained without restrictions that damage the economy, health (ex coronavirus), mental wellbeing and the country’s finances. France, which saw infections spike and restrictions imposed earlier than in the UK, had flash PMI figures for September that were both below expectation and below 50 implying contraction (Source Bloomberg, 2020). From April to August, £221.2bn was borrowed by the UK government, which is around 11x the next highest equivalent borrowing figure in the 36 years of available data and sets the UK on course for a peacetime record deficit (Source FT, 2020). It is an incredible challenge to balance protection of the vulnerable while optimising output of those that are low risk. I hope that effective test and trace and intelligent, nuanced policy can help achieve a good balance whilst the world waits for vaccines to become available.

Chart 1: Number of deaths involving COVID-19 by sex and age group, England and Wales, registered between 28 December 2019 and 11 September 2020

The Long and the short

Not exactly a pair this week, but it seems that if you can’t get away on holiday you might as well spend your down time with a lovely pet.

The Long

Pets at Home: This retailer sells a range of pet supplies and operates a joint venture with vets inside their retail outlets. We had some concerns about the vet side of the business due to lockdown preventing people taking their pets to the vet. However, trading has been phenomenal since the lockdown eased. Waiting lists for puppies have increased fourfold and prices have doubled according to an FT article (2020). The good news for Pets at Home, is puppies are not just for lockdown so there should be continued strong demand for their products and services for a long time to come.

The Short

Rolls Royce. A global engineering powerhouse that has been reduced to its knees by the current crisis. Airliners are hardly flying their current fleet and cancelling new orders. Rolls Royce is facing low demand for new engines and less maintenance of in use engines. The cash strain is material and the company seems likely to do a large rights issue.

Sources

https://www.bbc.co.uk/news/health-53938272

https://www.ft.com/content/dfc30728-7552-4c4e-80e8-872c52368398 (UK Debt)

https://www.ft.com/content/1d14541e-0c11-48bb-90a1-3f7dc05258a6 (Puppies)

The securities above are shown for illustrative purposes only. Their inclusion should not be interpreted as a recommendation to buy or sell.

For Professional Clients/ Qualified Investors only – not for Retail use or distribution. This is a marketing communication and as such the views contained herein are not to be taken as advice or a recommendation to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are, unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and investors may not get back the full amount invested. Past performance and yield are not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. This communication is issued in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. Registered in England No. 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

0903c02a82a0d5d0