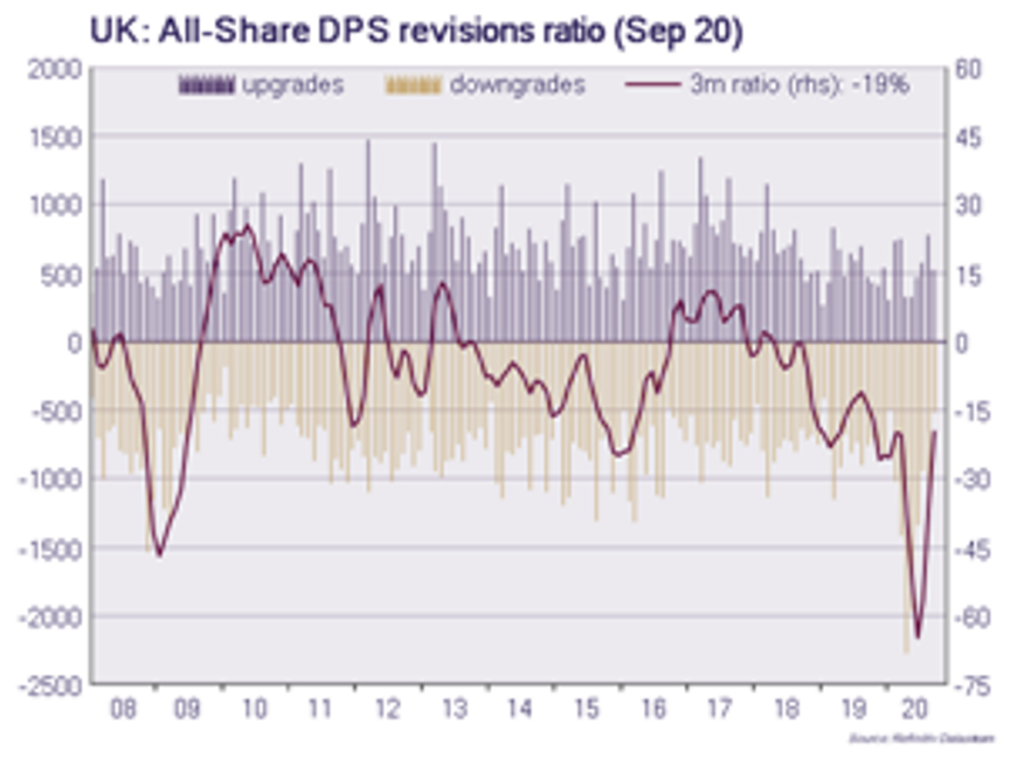

Following the unprecedented dividend cuts we saw across the UK market earlier this year, it finally appears there is some light at the end of the tunnel. During the first wave of the pandemic, the Link Group produced their Q1 dividend report which detailed a best case dividend scenario for the UK market of -27% in 2020 compared to 2019. As it became clear the impact of the pandemic was going to be more drawn out than the initial expectations, the subsequent Q2 report saw a downgrade to the best case scenario to -39%, with 2020 being described as ‘the biggest hit to dividends in generations.’ As we moved through the summer and the severe restrictions imposed on activity were relaxed somewhat, the downgrade trend in dividend estimates appears to have relented and in fact, September saw net dividend upgrades1 for the FTSE100, the first time since August 2018.

Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met.

In recent weeks we have seen a number of UK Housebuilders return to the dividend table, buoyed by steady house prices and a surge in demand driven by the Chancellor’s stamp duty holiday. Banks have yet to make a dividend comeback, despite strong capital ratios and limited impairments as the regulator continues to encourage them to preserve capital for lending purposes, however, I expect this to change as we move into 2021. Post the historic dividend cuts by Royal Dutch Shell and BP over the summer, the Oil & Gas sector is now paying dividends at a more sustainable payout level. The mining sector remains a shining beacon amongst the fog of dividend cuts, with resilient commodity prices and limited disruption to operations allowing many companies in the sector to continue to pay dividends.

Barring a new multi-month period of lockdown measures, I believe we are at, or very close to, the trough for UK dividends as evidenced by the charts above as companies have adapted to the new environment and imposed significant cost-cutting measures to make operations more efficient. With regards to dividend announcements, companies have understandably erred on the side of caution and this should lead to strong dividend growth, perhaps ahead of consensus expectations, as we move into 2021. Despite the cuts we have seen, the FTSE All-Share remains one of the highest yielding equity markets globally, with a current 12 month forward yield of over 4% (Bloomberg as at 21/10/20). In addition, the valuation picture relative to other markets is highly attractive, with the MSCI UK sitting at the largest discount to the MSCI World for more than four decades.

The JP Morgan UK Equity Income fund focuses on balance sheets, cash generation and sustainability of earnings, amongst other things, and as a result, the income premium offered to the FTSE All-Share has increased over the last six months with the 12 month forward dividend yield of the fund currently at 4.53% (underlying equity portfolio of the fund). The fund adopts an unconstrained approach, scouring the entire UK market with no constraints on stocks, sectors or payers/non-payers. We seek out a balance of high growth stocks, compounders, and high yielders which combines to offer an attractive dividend along-side capital growth. This unconstrained approach, together with the support of a well-resourced team, allows us to seek out hidden gems across the market, naturally leading us to be overweight in the small and mid-cap arena. The combination of the above has led to pleasing performance over the last 12 months and since the launch of the fund in May 2017. In the 12 months to the end of September 2020, the fund has outperformed the FTSE All-Share by 5.6% and sits first quartile in the peer group over 1 and 3 years2.

1 Peel Hunt data using a simple number of upgrades: number of downgrades.

2 Yield is not guaranteed and may change over time. Past Performance and yield are not a reliable indicator of current and future results

For Professional Clients/ Qualified Investors only – not for Retail use or distribution. This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are, unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Prior to any application investors are advised to take all necessary legal, regulatory and tax advice on the consequences of an investment in the products. Investment is subject to documentation, which is comprised of the Prospectus, Key Investor Information Document (KIID) and either the Supplementary Information Document (SID) or Key Features/Terms and Conditions. These documents, together with the annual report, semi-annual report and instrument of incorporation are available free of charge from JPMorgan Asset Management (UK) Limited. This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

0903c02a82a44407