It has been a rollercoaster ride for investors in UK equities – the most unloved stock market in the world – and especially so for fund managers like JPMorgan’s Georgina Brittain whose universe has a domestic focus.

For her, a net 35% of global asset allocators being underweight the UK is a positive – ‘that’s a whole lot of potential’ – and the longer-term spoils of owning mid-caps make riding the dips worthwhile.

‘Companies in this space outperform over the long term. It’s a really important part of ‘why mid-caps?’ and ‘why now?’ when they’re so out of favour,’ said Brittain, one of the longest tenured managers in the sector.

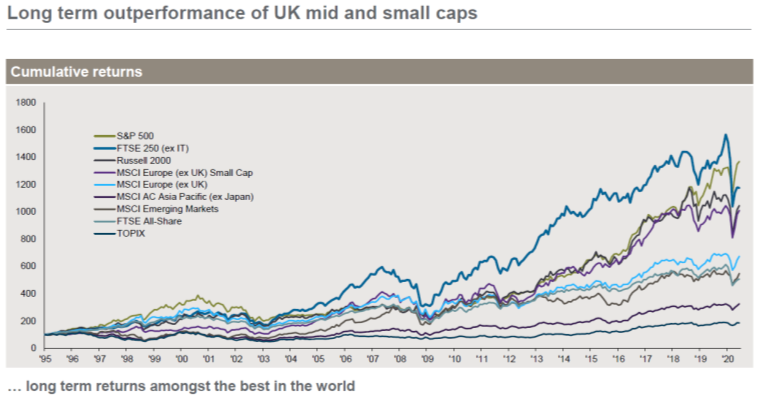

Over the past 25 years, the performance of UK mid-caps is second only to US equities (see chart), which have been catapulted ever higher by the march of the tech titans. The FTSE 250 has significantly outperformed leading stock market indices in Japan, the Asia-Pacific, emerging markets and Europe. It has also trounced the UK market overall.

In more recent years, Brexit-related headwinds have seen smaller companies underperform, not just relative to overseas indices but other parts of the UK market, notably large caps.

Trade talks ahead of the transition period ending on 31 December have been fraught with difficulty. ‘We are back in the eye of the storm for the umpteenth time,’ said Brittain. ‘The FTSE 250 bears the brunt of Brexit concerns. It’s an easy index to sell or short.’

Investor nervousness amid the coronavirus pandemic has also contributed. The FTSE 250 is heavily skewed towards sectors that have suffered disproportionately – financials, consumer stocks and property.

Ultimately, Covid-19 stands to lessen the blow of the no-deal Brexit she envisages: ‘If there was ever a time to have a bad Brexit, during a global pandemic is it.’

Plenty of firepower

Following December’s landslide election, Brittain and her co-manager Katen Patel entered 2020 in a bullish mood. Their JPMorgan Mid Cap Investment Trust was geared to the tune of 10% of net assets (compared to a maximum of 20% and minimum of 10% net cash).

As markets slid, the pair reduced gearing to 5% in March. They wanted firstly, to take risk off the table and secondly, to have plenty of firepower for buying opportunities. These have come from several quarters, chief among them retail and video gaming, and gearing has returned to 10%.

In line with other JPMorgan UK equity strategies, the managers’ stock-picking favours quality companies that are attractively valued and whose outlook is improving. Income is also important and the trust yields 3.1%. The board committed to and has announced the Company is maintaining the dividend this year thanks to significant revenue reserves.

Their key objectives during the sell-off and bounce-back was to maintain balance in the portfolio. ‘We deliberately didn’t want to sell out of everything that is very exposed to Covid,’ said Brittain. ‘That was absolutely the right decision. It felt uncomfortable in March and April, but we had done the analysis and were looking at the long term.’

They sold rail and coach ticketing platform Trainline, airport and railway station retail and catering concessionaire SSP Group and bus and rail service provider Go-Ahead Group. Other exits included Capital & Counties Properties, a property investment and development company focused on Covent Garden.

They held onto housebuilders Bellway and Vistry and have been pleasantly surprised by the strength of their trading. They also retained buy-to-let lender OneSavings Bank and holiday operator Jet2, which traded ‘extremely strongly’ up to March, beating market expectations and winning market share following the demise of Thomas Cook. ‘It was a winner before and will be a winner again,’ said Brittain.