The continuation of Brexit trade talks is seen as a positive for JPMorgan UK equities fund manager James Illsley.

‘There must have been some ground given for talks to continue. We always knew there would be a lot of posturing and it would go to the wire,’ he said, after another deadline passed on Sunday night without resolution.

He pointed to a ‘change in language’ from EU Commission president Ursula Von der Leyen. Her previous rhetoric of ‘significant differences remain’ has been replaced by talk of ‘useful’ discussions and negotiators being told to ‘go the extra mile’.

‘It looks like at least one of the sides has shifted its red lines,’ said Illsley. ‘What we don’t know is who has blinked, who has given ground? At the margin, it’s positive. The fact that no deadline has been set suggests that the negotiators need a reasonable amount of time to work through this new political framework.’

Regardless of a trade agreement being reached by the end of the transition period on 31 December, Illsley believes Britain remains home to many quality companies trading at attractive valuations.

‘Deal or no deal, valuations stand out,’ he said. ‘International investors have reduced exposure to UK stocks relentlessly over the past four years – there’s a limited number of meaningful sellers left.’

Lower entry level

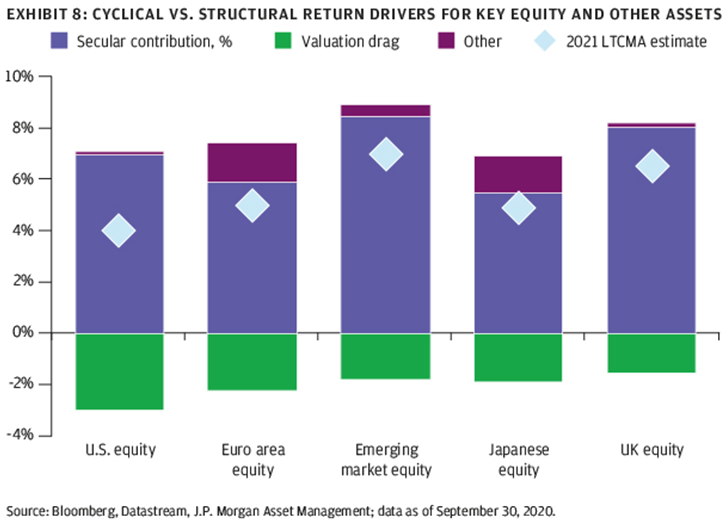

Elevated valuations in other developed markets, notably the US, have informed the 25th edition of JPMorgan’s long-term capital market assumptions, which expects the UK to be the second top-performing equity market next year, in part due to its lower entry level.

It expects UK equities to return 6.7% in sterling terms in 2021, second to emerging markets at 7.2% in US dollar terms. This is followed by the eurozone at 5.2%, Japan at 5.1% and the US at just 4.1% (see chart), all in local currency. Equities globally are expected to return 5.1% in dollar terms.

Illsley is one of four managers named on the JPM UK Equity Core and JPM UK Equity Plus funds, the latter being one of the few funds in the UK all companies sector that seeks to add alpha by taking short positions as well as long positions.

The managers spend 80% of their risk budget on stock selection – looking for quality companies with operational momentum trading at reasonable valuations – and have holdings among both overseas earners and domestic names.

Overseas earners

Around 70% of revenues generated by FTSE 100 companies come from overseas. ‘The UK stock market is not a mirror of the UK economy – we’ve been saying that ad nauseam since the referendum [in mid-2016],’ said Illsley. ‘For a lot of companies, Brexit is not a major issue.’

He gave the example of Rio Tinto, the Anglo-Australian diversified miner which is predominantly exposed to China for its sales. It accounts for 2.8% of the FTSE 350 index – more than the 2.4% weighting of the entire general retail sector.

Rio is benefiting from demand for iron ore amid Chinese infrastructure investment, which pushed its price beyond $150 a ton and earned it the title of this year’s best-performing major commodity. It could also be a beneficiary of the electric revolution since copper is a significant component in the manufacture of electric vehicles.

The managers also own AstraZeneca, one of the world’s fastest growing pharmaceuticals companies and a position that pre-dates the coronavirus pandemic.

Not all British businesses with overseas exposure are thriving, however. The JPM UK Equity Plus fund is short Aston Martin Lagonda. It fails on all three of the managers’ criteria: in its 105 year history it has gone bankrupt 7 times, it has a challenged balance sheet with high capital requirements; it has had operational issues causing multiple profit warnings; and its shares are expensive.

Domestic names

The managers have been marginally adding risk to the portfolios, mainly linked to the UK’s recovery from Covid-19 as opposed to Brexit. They have been increasing exposure to cyclical stocks, such as coach operator National Express and housebuilders Bellway and Barratt.

‘People often use housebuilders as a Brexit posterchild,’ said Illsley. ‘Compared to 2016 they are still cheap but land is one thing the UK can’t make more of.’

Domestic banks have been another area of focus, with positions in NatWest and Barclays topped up in the late summer and early autumn. They have also added to general retailers amid the pandemic – Next, Dunelm and JD Sports.

‘Those [retailers] left in the UK market are very much strong operations,’ said Illsley. The one notable exception is Marks & Spencer, which JPM UK Equity Plus shorts. It has struggled to transition to a hybrid bricks-and-mortar/online model, is ‘over-spaced’ on the high street with too many stores and its earnings have been in decline for years.

‘It’s one of the few large retailers left that we aren’t overweight,’ said Illsley. ‘We keep it under active review – the valuation is low but we’d need to see a turnaround in operational performance [to go long].’