November is one of my least favourite months. The weather gets notably cold, it is dark and there are at least four more months till things brighten up a bit. This November has been so busy I’ve not had much time to dwell on my loathing. We’ve had the US election, a lockdown and light at the end of the tunnel with three effective vaccines. What a time to have a new-born baby keeping me up all night!!!

On three successive Mondays, we had statements about three vaccines that each showed strong efficacy. The Pfizer and Moderna vaccines use mRNA technology. This type of vaccine works by inserting genetic code into our cells to produce the relevant viral proteins, which are harmless, but elicit an immune response from our bodies that leads to immunity. This concept has been around for many years but these are the first vaccines to successfully reach phase III end points. Both vaccines have efficacy of over 90%, which is extraordinary considering the FDA set the cut off at 50% for considering emergency approval (Source: The Scientist). The success of these vaccines has broader read across as this approach has exciting potential to combat a range of infectious disease as well as other illnesses like cancer.

AstraZeneca’s vaccine is also hugely exciting. The vaccine seems to have greater efficacy at a lower dose; 90% efficacy vs 62% in the higher dose. This has surprised some experts, particularly given the lower dose was a function of a manufacturing error. The company looks likely to do a follow-up trial to confirm the results. Nonetheless there is plenty to be excited about. The vaccine works by genetically altering an adenovirus that typically causes colds in chimpanzees so that it does not multiply and contains the coronavirus spike protein, which then elicits an immune response. The cost of the drug is a fraction of the other two (partly because AstraZeneca will not look to make a profit from the vaccine during the pandemic), it is far easier to store and production capacity is significantly higher (Source: NY Times).

The ramp up of these novel approaches to vaccination will present challenges and the mRNA vaccines need to be stored at sub-zero temperatures (Pfizer’s vaccine at -70°C). However, the logistical challenges seem surmountable when considering the unprecedented achievement of developing these vaccines in record time. They have the potential to protect billions of people over the course of 2021 and beyond and will facilitate a return to a way of living that we all miss so dearly.

The response from the market was emphatically positive with the market up 14% over the month (as at 27/11/20). It was led by the most beaten up stocks and sectors; travel & leisure, banks and oils. This value rally has once again stoked the debate about value vs growth and whether the rally can sustain itself. For me the answer is yes, for twelve months or so, but the market will become more discerning.

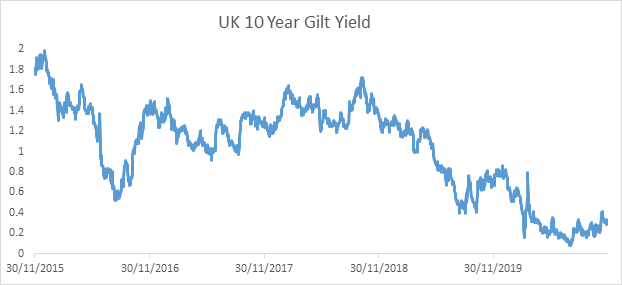

After a year of extraordinarily accommodative monetary, policy yields remain extremely low (see the chart below; Source: Bloomberg). Given the amount of debt governments have taken on through this period, central banks will not be looking to raise rates any time soon and will, in fact, welcome a bit of inflation to erode the real value of the debt pile.

However, the majority of economies are talking about big fiscal spending and economies are expected to grow rapidly off a beaten up base. This, I believe, will drive yields upwards, at the margin, and a return to pre-crisis levels does not seem unreasonable. Rising yields support value over growth as the future earnings that growth companies promise are discounted back to today at a higher rate. Further from an earnings perspective cyclical upswings, inflation and higher yields support the earnings of a number of value sectors such as industrials, commodities and banks.

For the value rally to sustain itself, on a multiyear view, I think we would need sustained high economic growth, inflation and rising yields. For some stocks, I think the value rally has already gone too far. Some of the travel stocks, for example, have burnt significant cash throughout this year and will continue to do so until travel volumes pick up to a more normalised level. They have funded this by taking on considerable debt and issuing equity. After the recent rally some of these stocks are trading at an enterprise value (debt plus equity) that is greater than it was pre crisis. In my view this is illogical as the risks facing them remain significant and there is still more debt to be piled on as they burn cash through winter. Only focusing on the equity or looking solely at the share price and anchoring on pre-crisis levels is naïve. I think the market will recognise this over, what is likely to be a miserable, winter before we emerge to brighter future.

The Long and the short

The Long:

Natwest Group: A cheap bank that has prudently provisioned for the reckoning that is coming as government support rolls off next year. The company reported a Common Equity Tier 1 ratio (CET1) of 18.2% at Q3 results. CET1 is a measure of the amount of capital a bank has to withstand financial distress and Natwest target 13-14%, the excess above this target level is worth around £5bn or c.25% of the Natwest’s market cap. Natwest also reported strong pricing in the UK mortgage market, good cost control and better provisions than expected, all of which are driving earnings up. The combination of potential capital returns and earnings momentum, as well as a cheap valuation, is a rare one.

The Short:

Carnival: The cruise ship owner operator has bounced strongly from the lows but using FY20 consensus net debt numbers now has an enterprise value just 15% below pre-crisis levels yet faces incredible uncertainty as to when operations can fully resume. In the meantime the company guided Q4 cash burn to be $530m a month at their last equity raise in early November (Source: Company Documents).

Sources:

https://www.the-scientist.com/news-opinion/the-promise-of-mrna-vaccines-68202

https://www.nytimes.com/2020/11/24/health/astrazeneca-covid-vaccine.html

https://www.carnivalcorp.com/static-files/3de07524-da99-42b5-ac19-55ee60fef4fc

The securities above are shown for illustrative purposes only. Their inclusion should not be interpreted as a recommendation to buy or sell.

For Professional Clients/ Qualified Investors only – not for Retail use or distribution. This is a marketing communication and as such the views contained herein are not to be taken as advice or a recommendation to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are, unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and investors may not get back the full amount invested. Past performance and yield are not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. This communication is issued in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. Registered in England No. 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

Material ID 0903c02a82a945bc