It is a new year but unfortunately there is no watershed moment. 2020 humbled my way of thinking a few times. I’ve accepted the pandemic has changed some aspects of life for the long term. This is not inherently a bad thing; I will not miss commuting five times a week. I hope a lot will return to normal but accept it will be a gradual build and, managing my expectations of this, makes life easier. I remain optimistic and I have been amazed with the vaccine roll out, so far. However, I will try to keep a lid on my day dreams of reunions with friends and family.

I mentioned in my last blog that the first quarter of 2021 could be the worst of the crisis. Looking back at the previous month, January has certainly helped to shape that suggestion. The inspiring news amongst the deluge of demoralising news is the success of the roll out of the vaccine. Towards the end of December 500,000 people had received their first dose in the first two weeks since regulatory approval. The latest figure (23rd January) is 492,000 people received their first dose in a single day (source GOV.UK). In total 6.3 million people have received their first dose and the government is on track to achieving their target of 15 million people by 15th February. The other glimmer of hope is that the number of daily cases is falling with the 7 day average now nearly a third lower than at the peak (source GOV.UK). A combination of an increasingly vaccinated population, fewer cases and better weather should combine to ease the strain on the NHS. These factors will allow the government to reassess policy, but they are likely to do so cautiously.

To hedge my optimism about the UK’s success, it is worth acknowledging that ultimately this virus needs to be controlled globally. Only this will fully remove the risk of mutations and will allow global trade to fully reopen.

Since the start of the New Year the UK has been trading under the terms of the Brexit deal signed at the 11th hour. There are plenty of news stories of friction causing pain for importers and exporters on both sides of the channel. In time, some of this friction will be eased as companies become familiar with the requirements and restrictions. However, leaving a trading bloc increases the burden of trading with that bloc as an outsider; some of that friction and cost is here to stay. The economy, businesses and consumers will have to adapt. The flip side is that the government has the opportunity to demonstrate the value of the new freedoms and sovereignty that Brexit affords us. Arguably the value of these benefits are not as categorical or tangible as the costs of leaving the bloc and will take time to come to fruition. Hence, why I reserve judging the deal definitively at this early stage.

Anecdotally, listed companies have not run into issues with the trade deal. Having scale and the resources to get on top of the changes in trading terms is a huge advantage. I suspect it will be smaller businesses that struggle most.

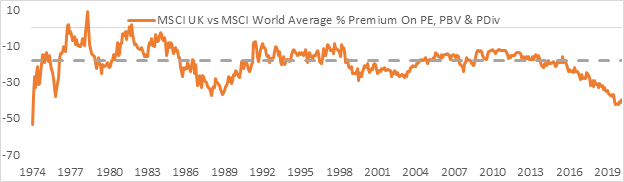

From a market perspective getting the deal is welcome relief. The chart below shows that the UK’s equity market has traded at an increasingly large discount to the Global equity market. In part, this is due to sector make up (exposure to banks and energy). However, even when accounting for sector make-up, the discount has grown since 2016. Now that the big risk of crashing out has gone, I believe that this discount will reduce. The UK is well placed to benefit from a rebound in economic activity as and when the global economy starts to recover from Covid 19.

The Long and the Short

The Long

Softcat is a value added reseller of IT software and hardware to SME customers. It is UK focused and serves around 12,000 clients. The model is to incrementally add new clients, but more importantly go deeper with existing clients. This is supported by consistent recruitment of graduate level talent through the cycle that go on to deliver growing gross profit as they build experience and clients. It has been an incredibly successful model. We believe IT spend will remain a focus of spend for all corporates and increased tech complexity requires sophisticated partners, which suits Sotftcat as they seek to increase share of wallet.

The Short

Informa, the events company, has recovered strongly since the announcement of new vaccines. However, in line with my commentary in the main part of the blog, the return to normalcy will be gradual. The risk feels to the downside for events companies. These events will return at some point, but it seems the shares have got ahead of themselves on vaccine excitement.

Source Cases https://coronavirus.data.gov.uk/details/cases

Source Vaccinations https://coronavirus.data.gov.uk/details/vaccinations

The securities above are shown for illustrative purposes only. Their inclusion should not be interpreted as a recommendation to buy or sell.

For Professional Clients/ Qualified Investors only – not for Retail use or distribution.

This is a marketing communication and as such the views contained herein are not to be taken as advice or a recommendation to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are, unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and investors may not get back the full amount invested. Past performance and yield are not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. This communication is issued in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. Registered in England No. 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

0903c02a82af3c76