A host of UK smaller companies have reported results ahead of analysts’ expectations in what JPMorgan fund manager Katen Patel deems to be the start of a strong re-rating for domestic earners.

‘The Covid-19 crisis hit UK company earnings hard last year – mid and small cap companies were the worst affected,’ he said. ‘But we’re starting to see a lot of upgrades to consensus forecasts, which underlines our conviction that the outlook for UK smaller companies is the brightest it’s been for years.’

Peel Hunt is pencilling in a near 20% jump in UK smaller company earnings this year and next, taking the price/earnings ratio of the Numis Smaller Companies plus Aim index to 14.7 in 2021 and 12 in 2022.

Patel and Georgina Brittain, co-managers of the JPMorgan UK Smaller Companies fund, have re-positioned the portfolio to benefit from a sharp economic recovery. Around 60% of its earnings come from the domestic economy compared to 48% for the index.

‘There are lots of reasons to be positive about the UK,’ said Patel. ‘There will be teething issues behind the scenes but Brexit is no longer in the headlines – companies have a good deal of certainty and we can move on from that. Moreover, the vaccine rollout has exceeded expectations and is one of the fastest in the world.’

The UK is third to Israel and the United Arab Emirates in its speed of administering Covid-19 vaccines. As of 16 March, it had administered 39.8 single doses per 100 people, compared to 67.4 for the UAE and 109.8 for Israel, according to the Our World in Data project at the University of Oxford.

UK consumer

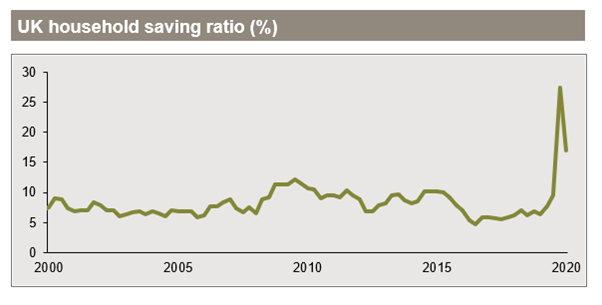

The resurgence of the UK consumer also bodes well for the fund’s overweight positions in retail and leisure stocks. The household savings ratio (savings as a proportion of disposable income) surged from 9.6% in the first quarter of 2020 to 29.1% in the second – a record high since official figures began in 1987 – before receding to 16.9% in the third quarter (see chart). The Office for Budget Responsibility expects forthcoming data to show a second peak in household savings in late 2020 or early 2021.

‘Huge swathes of the population have managed to save more money in the past year because they haven’t been able to spend – I’ve seen figures ranging from an extra £140 billion to £170 billion,’ said Patel.

‘Some of that will feed back into the economy in the second half [of 2021], particularly the domestic economy. While we can expect a certain amount of international travel to resume, the government will remain wary about an overseas strain [of the virus] being brought in.’

UK stock valuations are at a 35-year low relative to the US after adjusting for sector biases (the US market’s to technology – one of the key beneficiaries of the Covid-19 crisis – and the UK’s to cyclical sectors like financials, energy and mining, which have been among the hardest hit). UK domestic stocks are cheaper still, having underperformed international earners by 40% since the EU referendum in mid-2016.

Valuation is important to the managers (the fund’s free cash flow yield is 6.1% relative to 4.9% for the benchmark) but so too is quality. While the rotation to value seen in the first quarter of 2021 has propelled highly indebted, ‘grubby’ stocks higher, Patel reckons higher quality cyclical names will drive the next leg up.

‘As we go through this results season, companies with solid balance sheets and great growth potential will be recognised by the market while a lot of the lower quality names will be exposed for what they are – value traps,’ he said.

UK HOUSEHOLD SAVINGS SOAR