Where are we now?

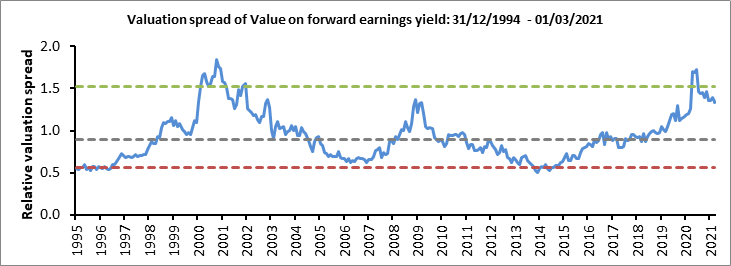

The dichotomy in performance between value and growth over the last decade is well documented but could this be drawing to a close? Even after the recent value rally, valuation spreads in the UK are extremely wide. At a global level it is even wider. The continued widening of spreads has materially impacted the performance of many multi-factor investors and has been the bane of quants worldwide. When one factor performs as poorly as value has done, it can corrupt the whole process.

Figure 1: Relative valuation spreads of value: FTSE All-Share xIT

How I think about this?

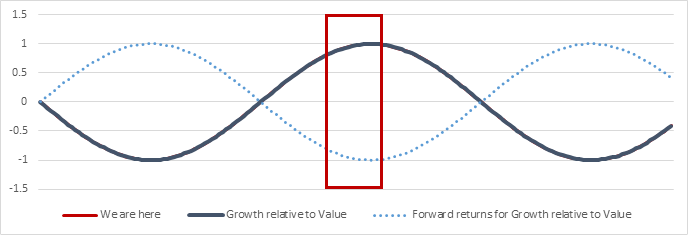

If we think about the cycle of growth vs value (assuming this relationship hasn’t broken down) then the potential returns from taking a bet on growth vs value at this point looks about as low as they ever have been relative to history. Despite this, global investors are all in on quality/growth funds and have abandoned value orientated strategies en masse over the last decade.

History teaches us that reversions tend to swing the pendulum sharply the other way which means the scale of reversion could be extremely large. As such, we shouldn’t see the risk as just a normalisation in value spreads but potentially a much more extended move.

The phrase “picking up pennies in front of a steam roller” comes to mind. And I know every investor is aware of the dichotomy in performance (and probably believes that it can’t go on forever) but it’s not reflected in many people’s asset allocation. Is this the time we should be willing to make a bet on value no matter how uncomfortable it feels? Otherwise, I want to hear you say “it’s different this time” and explain it to me

So, going back to the title: if not now, then when?

Figure 9: A completely fictional visualization of my thoughts based on theory/historical evidence

What can we learn from the tech bubble?

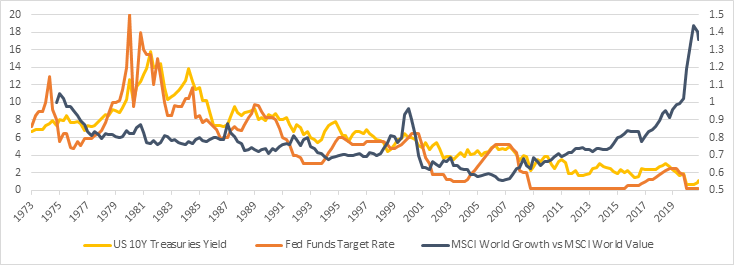

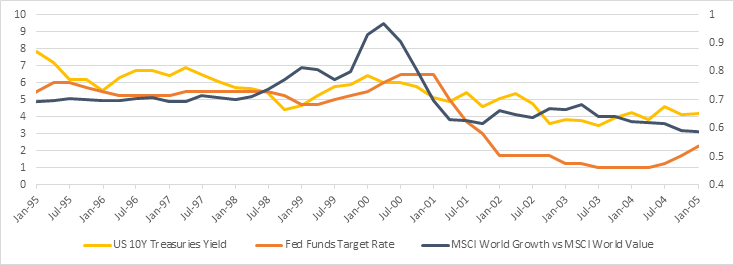

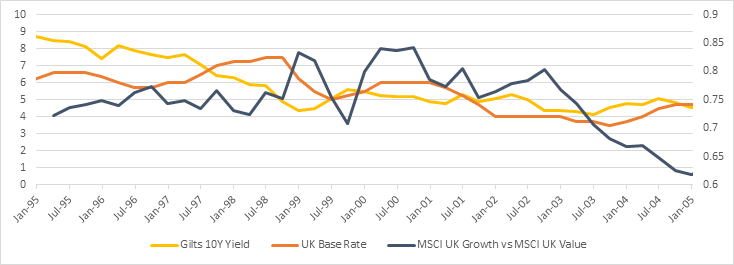

The period with the most obvious parallels is the tech bubble. A multi-year drawdown in Value which accelerated as the tech bubble reached its dizzying heights. The thing I find most curious is that the exact cause of the bubble bursting in early 2000 is a mystery. It seems there wasn’t a singular action that caused it. The Fed raised rates during 1999 but this wasn’t a surprise and growth continued to outperform value, despite this. I also think that looking through the relative performance of growth vs value over the tech bubble, the requirement that rates must be going up for value to outperform seems like an oversimplification. Rising rates make it mechanically more likely that value will outperform but that doesn’t speak to the behavioural favour of one type of stock relative to another.

Figure 6: Rising rates required for value to outperform?

Past performance is not a reliable indicator of current and future results.

Figure 7: What happened in the tech bubble in the US?

Past performance is not a reliable indicator of current and future results.

Figure 8: What happened in the tech bubble in the UK?

Past performance is not a reliable indicator of current and future results.

What can we do?

Nobody knows whether the current value rally is the start of something bigger or just a short-term rotation. But a careful consideration of risk vs. reward is crucial at this juncture. Exposures can become extended during long periods of the market moving one way. Investors can become comfortable with levels of risk that would have been shocking in the past but, as these risks have delivered over the last decade, they have been normalised. We continue to monitor the portfolio for names where we think the expectations/valuations may have got ahead of the reality but also for opportunities where names have become unfairly beaten up and look like a bargain.

For Professional Clients/ Qualified Investors only – not for Retail use or distribution.

This is a marketing communication and as such the views contained herein are not to be taken as advice or a recommendation to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are, unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and investors may not get back the full amount invested. Past performance and yield are not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. This communication is issued in Europe (excluding UK) by JPMorgan Asset Management (Europe) S.à r.l., 6 route de Trèves, L-2633 Senningerberg, Grand Duchy of Luxembourg, R.C.S. Luxembourg B27900, corporate capital EUR 10.000.000. This communication is issued in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. Registered in England No. 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

0903c02a82b09d82