The UK continues to track along the government’s road map to opening up. All the statistics are moving in the right direction and the vaccination effort has been exceptional. The government has promised a review of their guidance to work from home before stage four (the final stage). For office workers, there are diverse opinions about the optimal work from home/office balance. I believe there are significant and inimitable benefits to office work. I also believe working from home has its own unique benefits that I would be loath to give up completely. In all likelihood we, and most other office based businesses, will move to a hybrid model.

Results of a US survey by PWC suggested 29% of workers want to work remotely 5 days a week and 55% want to work 3 days or more remotely. The same survey suggested only 24% of executives expect many or all office employees to work remotely for a significant amount of time. There will be friction between executives and employees and getting that balance of home/office right will be tricky. There must be a level of critical mass which has to be reached to reap the benefits of office work. In the PWC survey executives and employees both have collaboration as a key benefit for being in the office, but if capacity is below 50% and half your meeting attendants are dialling in to meetings/discussions, do you really get that benefit? The survey suggests 18-24 year olds are more likely to want to work in the office, which anecdotally stacks up, training and passing on the culture of the company will require other cohorts to regularly be in the office to pass on their experience.

ONS data suggests that the number of people who travelled to work increased by 5% to 53% in mid-March. If the rollout of vaccines does keep a lid on the virus, then the opening up of the UK and a trend of normalisation of activity may change people’s opinions. What I do know, unequivocally, is having a beer after work on your own is not the same as standing outside a city pub with your colleagues when the sun is shining.

The memories of a beer in the sun with colleagues seems a long time ago but not as distant a memory as when the UK was last in favour with asset allocators. A major quibble with investors has been that the index is made up of value sectors that are not growing their earnings.

The pandemic decimated the earnings of a lot of big sectors in the UK such as the energy and banking sectors. The recovery promises a strong earnings recovery for these beaten up sectors. Signs of inflation and rising government bond yields make growth stocks, which have the majority of their value in outer year cash flows, less attractive as the discount rate for valuing these cash flows moves with these yields.

Bloomberg consensus forecasts the FTSE All-Share (UK index) to grow at a 21% CAGR 2021-2023, the S&P 500 (US index) is forecast to grow at a 16% CAGR 2021-2023. The FTSE All-Share trades on a 13x price to 2022 earnings ratio, the S&P 500 trades on a 20x price to 2022 earnings ratio. A stronger recovery in earnings and a 35% discount makes a strong case for buying UK equities.

You may still be sceptical about the UK equity market, but if we look on a like for like basis there are indications that the UK is mispriced. Exxon Mobile the US oil giant trades on 15x 2022 earnings, Royal Dutch Shell trades on just 8x 2022 earnings. This is not because Exxon has cracked the energy transition or has a meaningfully different business model to Shell. It appears to be purely about where it is listed.

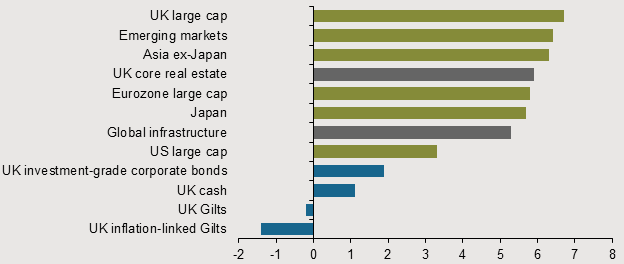

Do not just take it from a UK equity fund manager. The Long Term Capital Market Assumptions document that JPM produce each year has the UK as the most attractive asset class (see the below chart). This is the first time since I have been at JP Morgan that the UK has been the favoured asset class. It reflects the value opportunity and the rebound in earnings from the pandemic.

The Long and the Short

The Long

Barclays. I had Barclays as the Long in October 2019. It has been a wild ride but the stock is back where it was then, still trading on 0.5x book. I think the outlook has improved. It still looks cheap despite the rally from the pandemic lows. Consensus earnings estimates looks too conservative for its Global Markets business, where the implication is it will lose market share, when for the past three years it has gained share.

The company’s GDP growth assumptions look conservative compared to recent economic data points. This feeds through to provisions/impairments guidance that looks too bearish. They beat consensus estimates on impairments by 40% and 30% in Q3 and Q4. Interest rates are moving in the right direction, their relationship with the regulator, politicians and society is far better than post the Great Financial Crisis and they look well placed to returns capital to shareholders.

The Short

Fresnillo. The world’s largest silver miner performed extremely strongly during the heights of the pandemic as investors turned to precious metals as a store of value and the downward pressure on real yields pushed up the value of non-yielding assets like silver. These forces have largely reversed as investors are looking to buy into the recovery and yields are rising. Fundamentally the company has disappointed on production and cost for the last three years, yet the valuation is at a premium to peers.

Sources:

PWC Survey: https://www.pwc.com/us/en/library/covid-19/us-remote-work-survey.html#content-free-1-0f39

Consensus data is from Bloomberg

Government Roadmap: https://www.gov.uk/government/publications/covid-19-response-spring-2021/covid-19-response-spring-2021-summary

For Professional Clients/ Qualified Investors only – not for Retail use or distribution.

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are, unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Prior to any application investors are advised to take all necessary legal, regulatory and tax advice on the consequences of an investment in the products. Investment is subject to documentation, which is comprised of the Prospectus, Key Investor Information Document (KIID) and either the Supplementary Information Document (SID) or Key Features/Terms and Conditions. These documents, together with the annual report, semi-annual report and instrument of incorporation are available free of charge from JPMorgan Asset Management (UK) Limited. This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

0903c02a82b1313a