Do digital leaders outperform digital laggards? Corporate management teams and investors have considered the value of digitisation for years, with varying degrees of seriousness. When the pandemic forced a previously unimaginable amount of the world’s interaction – social, transactional, professional, medical, financial and educational – to move online to survive, it brought new urgency to the question.

We decided to see if we could find the answer by comparing digital leaders with digital laggards on a variety of metrics. We asked our Global Sector Specialists to identify the digital leaders and laggards within each of their industry sector(s) of expertise. The resulting group of 114 companies, across seven sectors[1], formed the basis of our analysis between leaders and laggards, while J.P. Morgan Asset Management’s extensive coverage of about 2800 stocks formed our coverage universe.

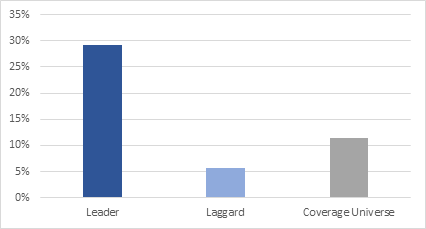

Five times faster earnings growth

To look at earnings growth, we used internal forecasts so that we could access more relevant annual earnings-per-share (EPS) growth on a five-year basis, which is not available using consensus estimates. Our analysis shows that digital leaders are forecast to grow at almost 5x the rate of the digital laggards and more than double the rate of the coverage universe. EPS growth is the key driver of expected returns on our five-year valuation framework, making this finding highly valuable from an investment standpoint.

EPS growth of digital leaders far outpaces the laggards

Higher return on equity – with less leverage

While growth is important, without producing returns on capital invested, it will not be sustainable. We therefore decided to investigate whether the digital leaders also had better return on capital than the laggards. We looked at return on equity (ROE) because the data for return on invested capital (our preferred metric) can be limited.[2] Once again, the digital leaders beat the laggards and the coverage universe, with a ROE of 19% compared to 15% and 14%, respectively.

The magnitude of the difference in ROE was notably less than the difference in earnings growth – but this is not so surprising. ROE is boosted by leverage (one of the reasons we don’t like to use it) and we suspected that the laggards’ ROE may be flattered precisely because they have more debt – so we also took a look at the leverage statistics of the two groups. Our analysis found that the digital leaders had a net cash position, with leverage at -0.08x, whereas the laggards had much higher leverage at 0.73x. This makes sense when considering the funding options for fast-growing companies: banks and the bond market are often closed to new companies with short track records, but private and public equity markets are much more welcoming, so the companies are often financed with equity rather than debt and tend to be quite cashed up.

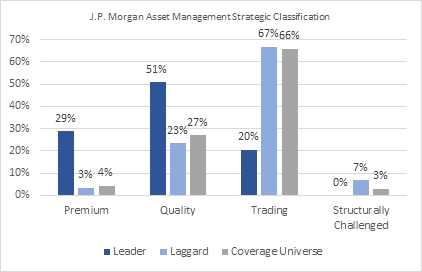

Higher quality companies

Lastly, we looked at our strategic classification of the two groups of stocks. This is an internal ranking of all companies covered by our analysts according to their quality. It is based on the economics, duration and governance of a company’s business. There are four categories: Premium, Quality, Trading and Structurally Challenged. We found that 80% of the digital leaders, compared to just 26% of the laggards, were classified as Premium and Quality; the Trading and Structurally Challenged classifications presented almost a mirror image, with 20% of leaders and 74% of laggards in these categories. Clearly, the digital initiatives and investment undertaken by the digital leaders are leading to better growth, profitability and duration, which shows up in these classifications.

Digital leaders scored well on our internal quality rating; laggards did not

Digitisation matters – for all companies

The digital revolution itself – one of our key long-term investment themes – is hugely significant for our investment outlook; it is not only relevant to the growth and profitability of the technology sector or for new companies, but for all kinds of companies across all sectors. Our analysis showed that many established companies – Paypal, Assa Abloy, Tencent, Otis, HDFC Bank, Allegion, Accenture, Mastercard, Nike, L’Oreal, Microsoft and Starbucks* have maintained leadership positions in their industries precisely because of their digital leadership.

Digital leaders are set to grow faster, with higher returns and less leverage than their laggard peers and scored significantly higher on our internal quality rankings. For corporate management teams and investors still considering whether digitisation matters, we can definitively answer the question – yes it does.

*The securities above are shown for illustrative purposes only. Their inclusion should not be interpreted as a recommendation to buy or sell

For Professional Clients/ Qualified Investors only – not for Retail use or distribution.

This is a marketing communication and as such the views contained herein are not to be taken as advice or a recommendation to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are, unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and investors may not get back the full amount invested. Past performance and yield are not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. This communication is issued in Europe (excluding UK) by JPMorgan Asset Management (Europe) S.à r.l., 6 route de Trèves, L-2633 Senningerberg, Grand Duchy of Luxembourg, R.C.S. Luxembourg B27900, corporate capital EUR 10.000.000. This communication is issued in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. Registered in England No. 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

0903c02a82b23aa4

[1] The sectors included in the analysis included Communication Services, Consumer Discretionary, Consumer Staples, Financials, Healthcare, Industrials and Information Technology. The sectors included were a result of the stocks identified as digital leaders or laggards by our 10 sector analysts.

[2] We removed those companies in both the leaders and the laggards which currently had negative EPS, given the lack of relevance of the last reported ROE to what that would look like by the end of the five-year period. The analysis also includes error handling by capping the ROE values in the top and bottom 2.5 percentile.